eMite Acquisition Earnings Update July 2015

eMite provides ‘Business Intelligence Analytics software’ to enterprise customers. Its products enable all businesses to make the right real time decisions by providing intuitive representation of real time data from any system in their company based on an easy to deploy, simply scalable BI system with top class analytics in a user adjustable interface.

About Prophecy International

Prophecy has 3 software businesses:

- SNARE: Event log management software. Enormous user base of clients as result of freeware version. Strong growth metrics.

- PROMADIS: Software for database/register management, eg. births, deaths, marriages register.

- BASIS2: CRM (Customer Relationship Management) software for the utilities industry. Oracle based software.

Prophecy Market Update

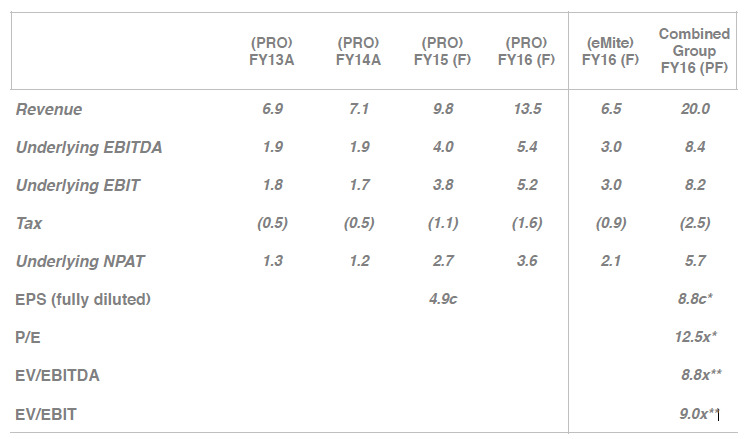

- Company advises preliminary (unaudited) accounts show a company record revenue of $9.8m (+41% on PcP) and EBIT of $4m (+137% on PcP) for FY15

- Strong results driven by new Snare License sales

- Snare sales pipeline for FY16 is at a record high

- Company anticipates growth momentum to continue into FY16

- Company continues to build its US sales and distribution team on the back of strong demand.

- For FY16 Prophecy (pre-eMite acquisition) is forecasting revenue of $13.5m, EBITDA of $5.4m and EBIT of $5.2m.

Prophecy to buy 100% of eMite

- eMite is a rapidly growing profitable business with market leading technology.

- eMite provides data analytics and business value dashboards.

- eMite, in combination with Snare will expand domain expertise in data analytics and data security.

- Blue chip client base include major financial institutions, government departments and corporate customers both domestically and internationally.

- Recognised by Gartner in 2014 as one of the top 2 highest product scores for Infrastructure and Operations Business Value Dashboards (IOBVD).

- Business model is highly scalable. Revenue model shifted towards a recurring SaaS model.

- Total acquisition price of between A$14.3m – A$17.8m.

- Acquisition multiple of 5.9x FY16 EBIT (assuming A$3.0m EBIT is met).

- Immediately highly EPS accretive and strategically coherent.

About eMite

- eMite provides ‘Business Intelligence Analytics software’ to enterprise customers.

- Its products enable all businesses to make the right real time decisions by providing intuitive representation of real time data from any system in their company based on an easy to deploy, simply scalable BI system with top class analytics in a user adjustable interface.

- What is eMite’s product?

Business Value Dashboards- Every hour eMite automatically provides information that CIO’s would normally read in a report once every month.

- eMite brings businesses a wide array of data and metrics in real-time, actionable information that is easily accessible, customisable and highly relevant to both IT and non-IT business stakeholders.

- Business users discover correlations and trends that are impossible to detect with standard BI solutions.

- eMite is a disruptive technology.

- Changing the game for IT Financial Management, through effective IT reporting.

- eMite’s Intellectual Property is developed in its head offices in Sydney.

- Large vendors (IBM, CA, BMC and HP) aren’t recognised by Gartner as having a solution in the BVD Space.

The Strategic rationale

- Bringing eMite and Snare together will greatly expand the company’s data domain expertise and footprint.

- eMite faces favourable long term market dynamics as its market is currently growing rapidly but from low overall penetration levels.

- Deal brings two great product technologies together (Snare, eMite) with strategic product coherence expanding data analytics footprint.

- Products will be synthesised providing an even more compelling value proposition to the end client of both products.

- eMite to leverage Prophecy’s US’ sales distribution team.

- Deal sets Prophecy towards $20m pa revenue business with strong earnings growth.

Market Opportunity

- ~$1.96Bn* eMite’s segment of The IT Operations Management (ITOM) market.

- Only 10% of CIO’s are currently building Business Value Dashboards.

- But……..This will grow to 50% within the next two years.

- Today: Many organisations choose to do nothing, as standard projects are high cost, hard to implement and geared to services.

- Future: easy implementation, low cost solutions will increase the number of potential customers and grow the market.

- Multiple young players offer a solution but the market needs are still evolving and solutions are constantly evolving with it (it is a young market).

- Smaller players are preferred by customers currently & higher rated by Gartner.

Experienced Leadership Team

Stuart Geros, Founder 1 & CEO

Stuart has over 25 years experience in the monitoring, benchmarking and capacity planning of IT systems. He has held every role that an IT provider has to offer working his way from junior programmer to managing director in the first 10 years of his career. Stuart’s previous experience was gained with Australian Software Innovations, Proxima and TechSMART International.

Darren Geros, Founder 2 & V.P Global Sales

Darren has over 20 years of Business Development and Management experience starting with Australian Software Innovations and progressing to AVOGA where he founded the company and later selling it to SMS Management Services. He has worked with global companies such as Compuware where he excelled in meeting growth targets and driving superior customer satisfaction. Darren has over 15 years experience in the event correlation, professional services and eCommerce industries and is a driving force in the growth of eMite.

Matthew Foster, Founder 3 and CTO

Matthew has over a decade of experience architecting, innovating and delivering solutions in the Systems Management marketplace. His passion for innovation coupled with experience in customer delivery led to eMite’s unique architecture which overcomes many of the challenges faced by partial solutions, legacy systems or product portfolios that are the result of a series of acquisitions. Matthew has held senior roles with HSBC and TechSMART International. He has a Masters of Engineering from Oxford University.

Investment Case

- eMite operates within a $2bn pa IT operations management market.

- Current adoption of IT operations software is 10% and expected to grow to 50% over the next 3-5 years.

- Recognised by Gartner and EMA as one of the world leading enterprise software products in the Business Value Dashboard and Operations Analytics space.

- Blue chip client base includes global financial institutions, government departments and corporate clients domestically and overseas.

- Prophecy is buying a fast growth business at a compelling valuation. Investment in additional marketing and sales resources will help accelerate growth.

- Building a specialised enterprise software business in the data analytics and security management space with high operating leverage and free cash flow conversion.

- Balance sheet remains robust post acquisition.

- Vendors taking significant amount of equity and committed to remain with the business to share in the growth of the combined group.

Financial Forecasts

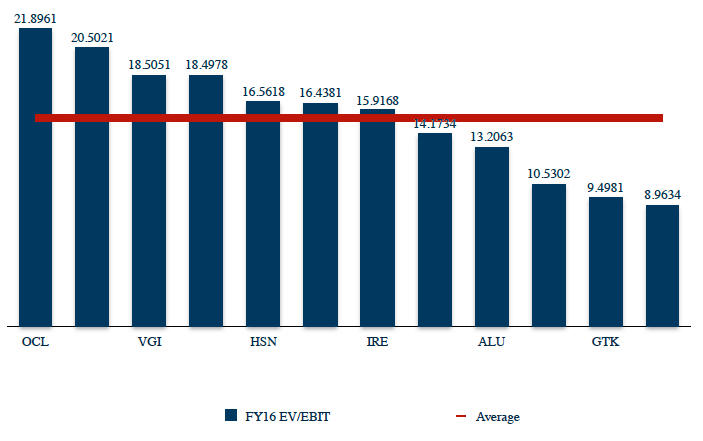

Software Sector Multiples